We love breaking news - whether good or bad news. We take it all in, refine it and sieve out the good from the bad; then convert them into profits 🙂

- UK Global Investors

Enjoy instant access to breaking news, market announcements and news articles on everything from forex, stocks, indices, commodities, companies and global economies.

News streams straight from over 50 providers, including central banks, credit rating agencies, financial exchanges, plus major news agencies Nasdaq, MarketWatch, Yahoo Financials & CNBC.

The Bank of Canada has cut rates by 25 basis points to 4.50%, but the Canadian dollar showed only a muted response to the rate cut.

Risk Sentiment Deteriorates With Big Tech Selloff, S&P 500 Index Worst Day in Almost a Year, Asian Stocks Follow Sharply Lower; Bank of Canada Cuts Rates by 0.25%; USD/JPY, Silver Hit 2-Month Low; Indian Rupee Still Threatens Record Breakdown

Bank of Canada Expected to Cut Rates by 0.25%; USD/JPY Hits 2-Month Low, US Dollar Bulls Push Into Resistance Zone; Indian Rupee Threatens Record Breakdown

Indian Rupee Gains After Flirting With Record Low; US Dollar Continues To Sit Below Resistance; VP Harris Favourite for Dem Nomination, Trump Favourite for Election; Stocks Rise Yesterday

Indian Rupee Makes Record Low Close Against USD; US President Biden Announces Withdrawing From Race, Endorses VP Harris; US Dollar Fails to Rise After Testing Resistance Zone at 103.92; US Stocks Edge Higher

NASDAQ 100 Index Suffers Worst Drop Since 2022, Asian Indices Lower; Markets Await ECB; Gold Threatens New Record High; US 10-Year Treasury Yield Hits 4-Month Low

We continue to see a global trend of inflation moving lower.

Gold Makes Strongest Daily Rise in Months to New Record; US 10-Year Treasury Yield Hits 4-Month Low; Some US Equity Indices Make Record Highs

Gold Closes Near High and Continues to Tick Higher in Asian Session; US Treasury Yields Falling on Prospect of Trump Victory; US Equity Indices Make Record Highs

Political Boost from Assassination Attempt Seen Likely, Trump 65% Probable to Win; US Treasury Yields Fall on Prospect of Trump Victory.

The European Central Bank recently released its monetary policy meeting minutes, showing that the bank’s policymakers supported the decision to continue with an accommodative monetary policy stance until March 2022.

Bank of England Governor Andrew Bailey said recently that the latest surge in the number of COVID-19 infections has put the British economy in shambles, delaying the country’s recovery.

According to recently released electoral data, the Democratic Party will likely grab the two Georgia Senate seats that were in dispute, giving the party a trifecta for the first time since 2009.

According to Germany's Federal Statistical Office, retail sales rose by 5.6% (annually) in November, higher than expectations of 3.9% but lower than the previous month's 8.6% rise.

The British House of Commons approved the trade agreement with the European Union yesterday in a 521-73 vote, ending the Brexit saga just before the deadline.

The US House of Representatives decided to back President Trump’s proposal to give additional stimulus payments to Americans in need, which has been a recent point of contention between both parties.

The end of autumn 2020 will forever go down in the story of the Forex market.

The Bank of Japan recently released its monetary policy meeting minutes, in which policymakers discussed forms of making their monetary stimulus measures more sustainable.

The US Federal Reserve recently announced its decision to leave the cash rates unchanged, remaining in line with analysts' expectations.

The United Kingdom’s Office for National Statistics recently reported the country’s unemployment rate, which stands at 4.9 percent for the third quarter, and lower than expectations of 5.1 percent.

In my daily NZD/JPY analysis, it’s hard not to notice that this has been like a “falling knife” as of late, and therefore sooner or later we needed to see some type of bounce.

In my daily USD/CHF analysis, it’s easy to see that the 0.88 CHF level is an area that we have a certain amount of support at.

The US dollar has extended its run against the Canadian dollar to the upside, and in my daily analysis, I can see that this asset still favors the US dollar over the Canadian dollar.

In my daily analysis of European indices, the MIB 40 in Italy stood out. We gapped lower to plunge quite drastically, and now find ourselves well below the €34,000 level.

In my daily silver analysis, the first thing I notice is that we dropped roughly 4% overnight, as the panic and the computerized continuation of noise continues.

In my daily analysis of the S&P 500, it's obvious to me that the market continues to see a lot of volatility, but it looks like the Americans are going to pick up the ball and carry it to much higher levels.

The British pound has plunged much lower against the Swiss franc, yet again during the trading session on Thursday.

In my daily Swiss franc against Canadian dollar analysis, it's easy to see that this pair continues to plunge lower.

In the daily Euro analysis, I can see that we initially dropped a bit only to turn around and show signs of life.

In my daily DAX analysis, the first thing I notice is that we have recovered quite a bit of the losses early in the day, and that tells me that there are still people out there willing to jump in and take advantage of cheap contracts.

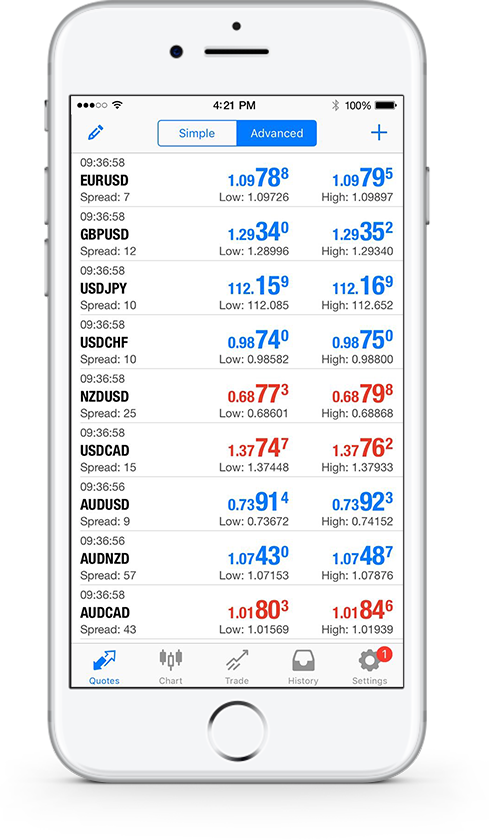

MARKET DATA:

UK Global Investors (UKGI) provides links to selected sources of market updates. Clients searching for how or the best way to invest use those sources through UKGI’s website. The sources are part of its free service for all market traders. UKGI sometimes agrees or differs with the updates as do other traders. Some of the updates are the views of the authors, writers and editors. The main aim is to provide balanced views across different markets.

We expect clients and traders to be thoughtful before acting on any market info. Be careful to process the market data received from our website before using such to trade. Sometimes market data and news items shown on this website come up after some delay. Our web portal receives rates and prices as-is. The web data may sometimes differ from the rates shown at the central data bank. This means the delayed market rates may not be suitable for use at that time. Thus we will not accept any blame for losses as a result of the use of delayed data.

UKGI helps clients and traders in need of safe ways to invest for the best. Contact the broker or trading firm for more info before you deposit funds. This web portal provides free articles, news items, research and related info. Clients should use them as-is. Traders should know how the sources help them as the best way to invest. UKGI takes neither credit nor blame from the use of its trading data. This applies to any profits or losses earned.

OUR SERVICE:

UKGI runs a free forex investing service by trading in the forex market. We earn profits on the capital and get paid by top tier 1 liquidity providers. Currency or forex trading comes with large rewards. The same applies to risks. Self traders must know how the rewards and risks affect their capital. They must accept both to earn from forex or the broad financial markets. Trading results usually vary over time. Factors for this include price feeds, demand and supply, breaking news, and others. We still apply them as tools to create the best way to invest.

Using margin to trade the markets raises the risk of profits or losses. Margin is funds borrowed from a broker. This adds to the account’s equity or balance for trading. It may thus lead to high risk trading. Take all the right steps to learn the correct info about market products. Know your financial goals as well as your risk level. Get expert advice on the best way to invest before making a deposit.

Copyright © 2023 | UK Global Investors